This comprehensive guide explores the critical concept of risk-reward ratio in trading and investing, explaining why maintaining a positive ratio is fundamental to long-term success in the financial markets. We’ll examine how to properly assess risk, define reward potential, calculate this essential metric, and implement it effectively in your trading strategy while avoiding common misconceptions.

T2 Markets

Understanding Risk in Trading

Risk in trading represents the potential financial loss an investor might face when entering a position. It’s the unavoidable companion to any investment opportunity, and understanding its multifaceted nature is crucial for survival in the financial markets. Risk isn’t merely a theoretical concept-it’s a tangible threat to trading capital that must be quantified, managed, and respected.

The most fundamental form of risk is market risk, which encompasses the possibility of prices moving against your position due to macroeconomic factors, changing market sentiment, or unexpected events. For example, a long position in a stock inherently carries the risk that the share price will decline. Beyond market risk, traders also face liquidity risk (the inability to exit positions at desired prices), counterparty risk (the possibility that the other party in a transaction defaults), and operational risk (losses resulting from inadequate procedures or human error).

Quantifiable Risk

Risk can be measured in absolute monetary terms (e.g., $500 potential loss per trade) or as a percentage of account value (e.g., risking 1% of total capital per position). Sophisticated traders may also use statistical measures like standard deviation or value- at-risk (VaR) to model potential losses.

Risk Management Tools

Traders employ various tools to control risk, with stop-loss orders being the most common. These automatic instructions to exit a position when prices reach predetermined levels help define the maximum acceptable loss before entering a trade.

Psychological Aspects

Risk perception is highly subjective and influenced by individual risk tolerance, emotional state, and cognitive biases. Even when using identical technical analysis, two traders might perceive very different risk levels in the same trade.

A mature approach to trading acknowledges that losses are inevitable4no trader wins every trade. The key difference between successful and unsuccessful traders often lies not in their ability to avoid risk altogether, but in how effectively they manage it when it materializes. Understanding your personal risk tolerance and establishing concrete risk parameters before entering any position creates the foundation for sustainable trading practices.

Defining Reward in Financial Markets

In trading and investing, reward represents the potential profit or return that can be gained from a particular position or strategy. While risk focuses on what might be lost, reward examines what might be gained4the positive counterbalance that makes assuming risk worthwhile. Understanding how to properly define and quantify reward potential is essential for making rational trading decisions.

Rewards in trading can take multiple forms. The most obvious is direct price appreciation, where an asset’s value increases after purchase. However, rewards can also come through dividends, interest payments, premium collection from options writing, or even tax advantages. Sophisticated traders often combine multiple reward mechanisms within a single strategy to enhance overall return potential.

Factors Influencing Reward Potential

- Price targets derived from technical analysis patterns, such as support/resistance levels, chart formations, or

Fibonacci extensions - Fundamental analysis projections based on valuations, earnings growth rates, or industry expansion

- Historical behavior of similar market setups, which may suggest probable ranges for future movement

- Volatility expectations, which impact the magnitude of potential price swings

- Time horizons, as longer holding periods typically offer greater reward potential but also increased uncertainty

Unlike risk, which can be definitively capped through stop-loss orders, reward potential often lacks a clear ceiling. Markets can sometimes exceed even the most optimistic projections, creating an asymmetric opportunity where the reward significantly outpaces the risk. This asymmetry is the foundation of positive risk-reward ratios.

Importantly, reward projections should be grounded in realistic analysis rather than hope or wishful thinking. Experienced traders develop systematic approaches to estimating reward potential, typically using a combination of technical indicators, fundamental catalysts, and statistical probabilities. They also recognize that reward estimates are inherently less certain than risk definitions, which is why conservative reward targets often prove more reliable for consistent profitability.

Calculating the Risk-Reward Ratio

The risk-reward ratio is a simple yet powerful mathematical expression that compares the potential loss of a trade to its potential gain. This straightforward calculation provides a quantitative framework for evaluating trading opportunities and making informed decisions about which positions to enter and which to avoid.

The Basic Formula

Risk-Reward Ratio = Potential Risk / Potential Reward

For example, if you risk $100 to potentially gain $300, your risk-reward ratio is 1:3 (or 0.33 when

expressed as a decimal).

Positive vs. Negative

A “positive” risk-reward ratio means the potential reward exceeds the potential risk (ratio < 1). A “negative” ratio means the risk exceeds the reward (ratio > 1).

Most professional traders aim for ratios of 1:2 or better (0.5 or lower).

The Basic Formula

To calculate the ratio for a stock trade:

- Risk = Entry Price – Stop Loss Price

- Reward = Profit Target – Entry Price

- Divide Risk by Reward

When calculating risk, it’s essential to include all potential costs, including spreads, commissions, and slippage. Similarly, when calculating reward, traders should account for any dividend payments, funding costs for leveraged positions, or tax implications that might affect the final return.

Benefits of a Positive Risk-Reward Ratio

A positive risk-reward ratio4where the potential reward exceeds the risk4serves as a cornerstone of professional trading approaches. Its benefits extend far beyond simple mathematics, creating a robust framework that supports both financial performance and psychological resilience. Understanding these advantages helps explain why successful traders almost universally advocate for favorable risk-reward profiles in their trading decisions.

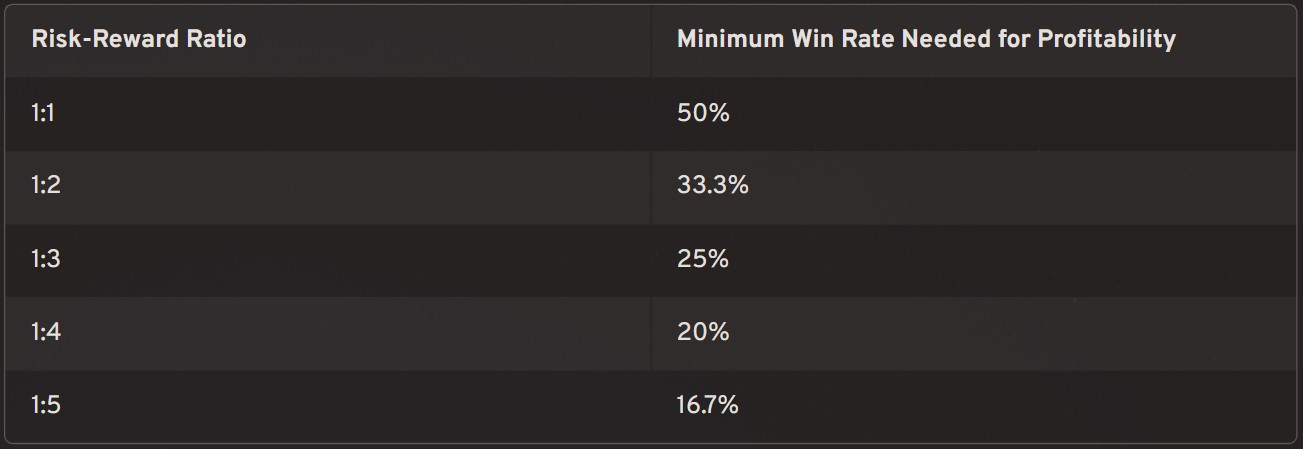

Mathematical Advantage: The Win Rate Equation

The most compelling benefit of a positive risk-reward ratio is that it allows traders to remain profitable even with a relatively low percentage of winning trades. Consider the following scenarios:

Capital Preservation

Positive risk-reward ratios inherently limit exposure on any single trade, helping preserve capital during drawdown periods and extending trading longevity.

Psychological Benefits

Knowing that winners will significantly outpace losers reduces the emotional impact of losing trades, helping maintain discipline and preventing revenge trading behaviors.

Compounding Advantage

Over time, the asymmetric returns from positive risk- reward trading accelerate account growth through compounding, as each winning trade contributes proportionally more to the bottom line.

Beyond these direct benefits, trading with positive risk-reward ratios encourages patience and selectivity. Rather than jumping into marginally favorable setups, traders become more discriminating, waiting for high-quality opportunities where the potential reward substantially outweighs the risk. This selective approach naturally improves overall trading quality and performance.

Additionally, the discipline required to maintain positive risk-reward ratios often leads to improved trading practices across the board. Traders become more rigorous about defining stop losses before entering positions, more thoughtful about setting realistic profit targets, and more committed to letting winning trades develop rather than taking premature profits. These habit improvements compound over time, creating a virtuous cycle of better trading decisions.

Implementing Risk-Reward Ratios in Trading Strategies

Successfully incorporating risk-reward analysis into trading requires more than mathematical understanding-it demands systematic implementation across various market conditions and trading styles. This practical integration transforms the concept from theoretical knowledge into a powerful decision-making tool that can significantly enhance trading performance.

Pre-Trade Analysis

Before entering any position, identify specific entry points, stop-loss levels, and profit targets. Calculate the resulting risk-reward ratio and only proceed with trades meeting your minimum threshold (typically 1:2 or better).

Trade Filtering

Use risk-reward criteria to screen potential setups, automatically eliminating opportunities that don't offer sufficient reward relative to risk. This creates a quality filter that improves overall trade selection.

Position Sizing

Adjust position sizes inversely to risk-reward ratios4allocate smaller percentages of capital to trades with less favorable ratios and potentially larger allocations to exceptional setups with highly favorable ratios.

Active Management

Reassess risk-reward during the trade as market conditions evolve. Consider techniques like trailing stops or partial profit-taking to maintain positive expectancy as trades develop.

Adapting to Different Trading Styles

Risk-reward implementation varies significantly across trading approaches:

- Day Trading: With tighter profit margins and higher frequency, day traders might accept slightly lower ratios (1:1.5) but demand higher win rates and quicker resolution.

- Swing Trading: The multi-day holding period typically allows for wider stops and larger targets, enabling more favorable ratios (1:3 or better) that compensate for lower trade frequency.

- Position Trading: Long-term positions can target major support/resistance levels or fundamental valuations, often achieving very favorable ratios (1:5+) that justify the extended time commitment and uncertainty.

Successful implementation also requires adapting to different market conditions. During periods of high volatility, wider stop-losses may be necessary to avoid premature exits, requiring correspondingly larger profit targets to maintain favorable ratios. Conversely, in range-bound markets, narrower ranges between support and resistance might necessitate more modest profit targets and tighter stops.

Record-keeping becomes especially important when implementing risk-reward ratios. By tracking the actual performance of trades against their projected ratios, traders can identify patterns and make adjustments. For instance, if you consistently achieve only 70% of your projected reward targets, you might need to set more conservative targets or implement earlier partial profit-taking. This continuous feedback loop allows for progressive refinement of your risk-reward approach, leading to increasingly accurate projections and better trading outcomes over time.

Common Pitfalls and Misconceptions

Despite its apparent simplicity, implementing risk-reward analysis effectively involves navigating numerous challenges and avoiding common traps. Even experienced traders can fall victim to misconceptions that undermine the benefits of a positive risk-reward approach. Recognizing these pitfalls is the first step toward addressing them.

The Optimization Illusion

One of the most pervasive misconceptions is that extremely favorable risk-reward ratios (like 1:10) are inherently superior to more moderate ratios (like 1:3). This “optimization illusion” ignores the crucial relationship between risk-reward ratios and probability of success. Targets that are set too ambitiously may look impressive on paper but significantly reduce the likelihood of the trade reaching its profit objective. The optimal approach balances favorable ratios with realistic probability assessments.

Moving Target Syndrome

False Precision

Context Blindness

Implementation Challenges

- The Phantom Stop: Calculating risk based on theoretical stop-loss levels without actually placing the orders in the market, creating vulnerability to emotional decision-making during adverse price movements.

- Slippage Blindness: Failing to account for execution slippage, especially in less liquid markets or during volatile conditions, which can significantly worsen actual risk-reward outcomes compared to theoretical calculations.

- Overemphasis on Technical Levels: Basing risk-reward calculations exclusively on technical chart points without considering fundamental catalysts or volatility conditions that might render those levels irrelevant.

- Inconsistent Application: Being disciplined with risk-reward analysis during winning streaks but abandoning the approach after a series of losses, precisely when its mathematical advantage is most needed.

Perhaps the most dangerous misconception is viewing risk-reward analysis as a guarantee rather than a probabilistic edge. No risk-reward ratio, no matter how favorable, ensures success on any individual trade. The advantage manifests across a large sample of trades, which requires maintaining discipline through inevitable losing periods. Traders who abandon their systematic approach after a few losses often never experience the long-term benefits that positive risk-reward ratios can provide.

Conclusion: Maximizing Success with Positive Risk-Reward Ratios

Throughout this comprehensive exploration of risk-reward ratios in trading, we’ve established that maintaining a positive ratio4where potential rewards exceed potential risks4serves as a foundational principle for sustainable trading success. Rather than being merely a mathematical convenience, this approach represents a disciplined trading philosophy that acknowledges market realities and human psychology.

The power of positive risk-reward ratios lies in their mathematical advantage: they allow traders to remain profitable despite experiencing a significant percentage of losing trades. This buffer against inevitable losses creates resilience in trading systems and supports psychological stability during drawdown periods. When consistently applied across hundreds of trades, even modest risk-reward advantages compound into substantial performance differences.

Balanced Approach

Performance Tracking

Consistent Discipline

Contextual Adaptation

Adjust risk-reward expectations

to different markets, timeframes,

and strategies

Successful implementation requires moving beyond mere calculation to develop an intuitive understanding of favorable market opportunities. Experienced traders often internalize risk-reward thinking to the point where they can quickly assess setups without explicit mathematical analysis, developing a “feel” for whether a potential trade offers sufficient reward relative to its risk.

The journey toward mastering positive risk-reward trading is ongoing. Markets evolve, trading styles mature, and personal circumstances change. What remains constant is the fundamental logic: by consistently seeking situations where what you might gain exceeds what you might lose, you tilt the playing field in your favor. This patient, probabilistic approach distinguishes professional traders from gamblers and forms the backbone of sustainable trading careers.

In closing, remember that risk-reward ratio analysis is not merely a technical tool but a framework for rational decision-making under uncertainty. When combined with proper position sizing, realistic probability assessment, and disciplined execution, it creates a robust foundation for trading success that can withstand the inevitable challenges of financial markets. By embracing this approach, traders position themselves not just for occasional winning trades but for long-term profitability and capital growth