Trade #1 Turns Green – Add-In Pulse Bars Activated

Well, ain’t I a jammy sausage?!

Yesterday’s group call turned into a mini confessional. I admitted my bull swing from last week was struggling. And unlike most hopeful gamblers, I don’t average down a loser. It had to prove itself — or expire.

We called out a rally from the range lows during the morning session.

We got it. I entered a new swing.

And just as I braced for another washout…

the market turned. Hard.

Straight up from mid-morning to the bell.

“Cheeky, cheeky!”

Exit at 15:59 with a tidy 73.3% ROC.

Let’s zoom in on the setup that paid… and how to catch the next one.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

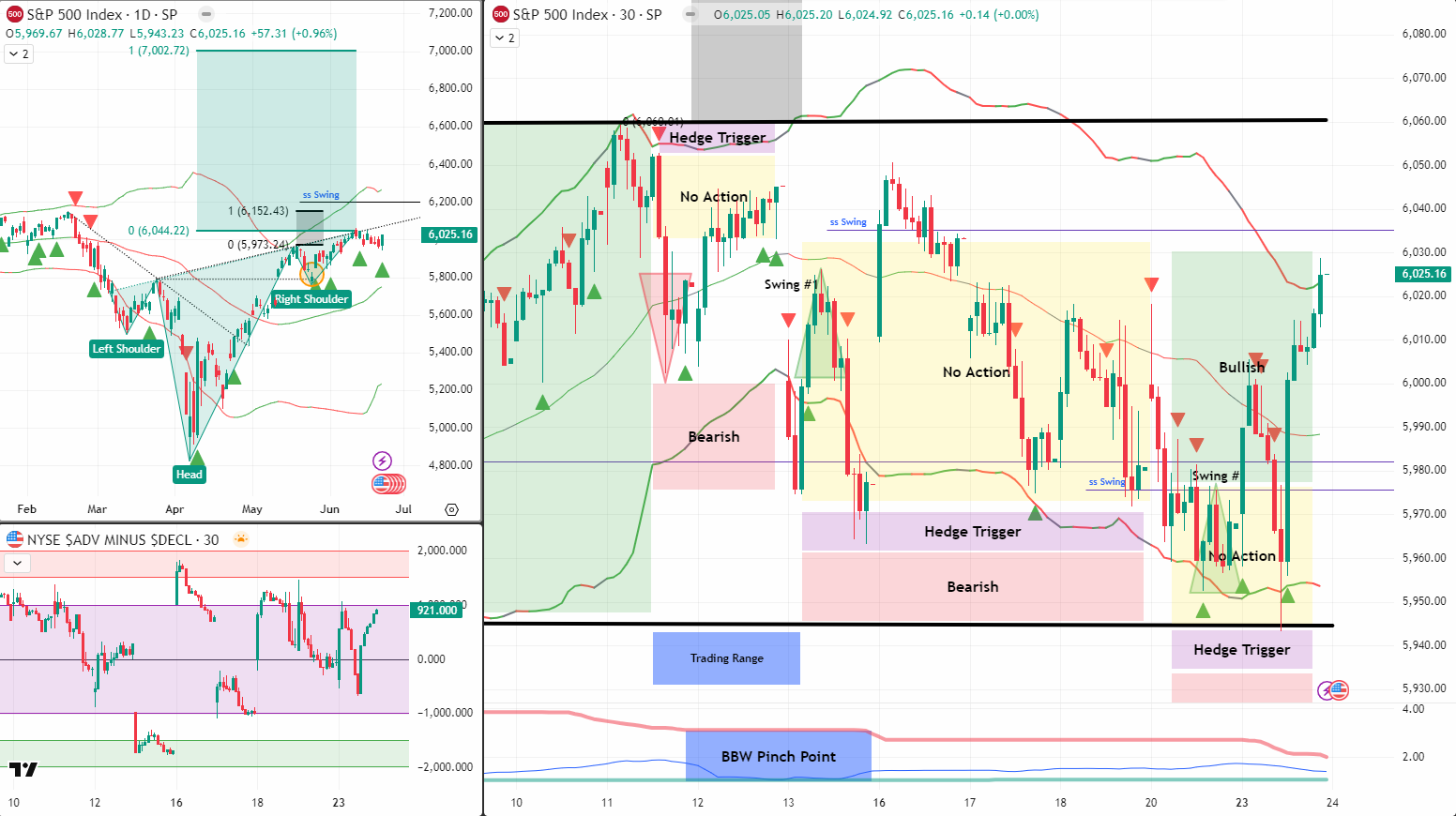

SPX Market Briefing

Today’s game plan builds on yesterday’s price behavior.

The new trade is in the green. That flips my mode into “Add-In Ready” – meaning new Pulse Bars can be stacked into strength if the setup justifies it.

But I’m not chasing. The range still matters.

My operating structure is:

-

Range high = 6060

-

Range low = 5940

-

Stay inside, play the levels. Break out? New game.

What changes things?

News flow.

A 12-day ceasefire in the Middle East just hit the wires. While geopolitical spikes haven’t broken the range yet, reduced tension could be just the psychological lift bulls need to push past 6060.

If that happens – I’ll be watching for a retest setup with size.

Until then, it’s system rules, pulse setups, and layered discipline.

Happy trading,

T2 Markets