Bollinger Bands Start Squeezing – Volatility Likely to Dip

Hi Traders!

What a week.

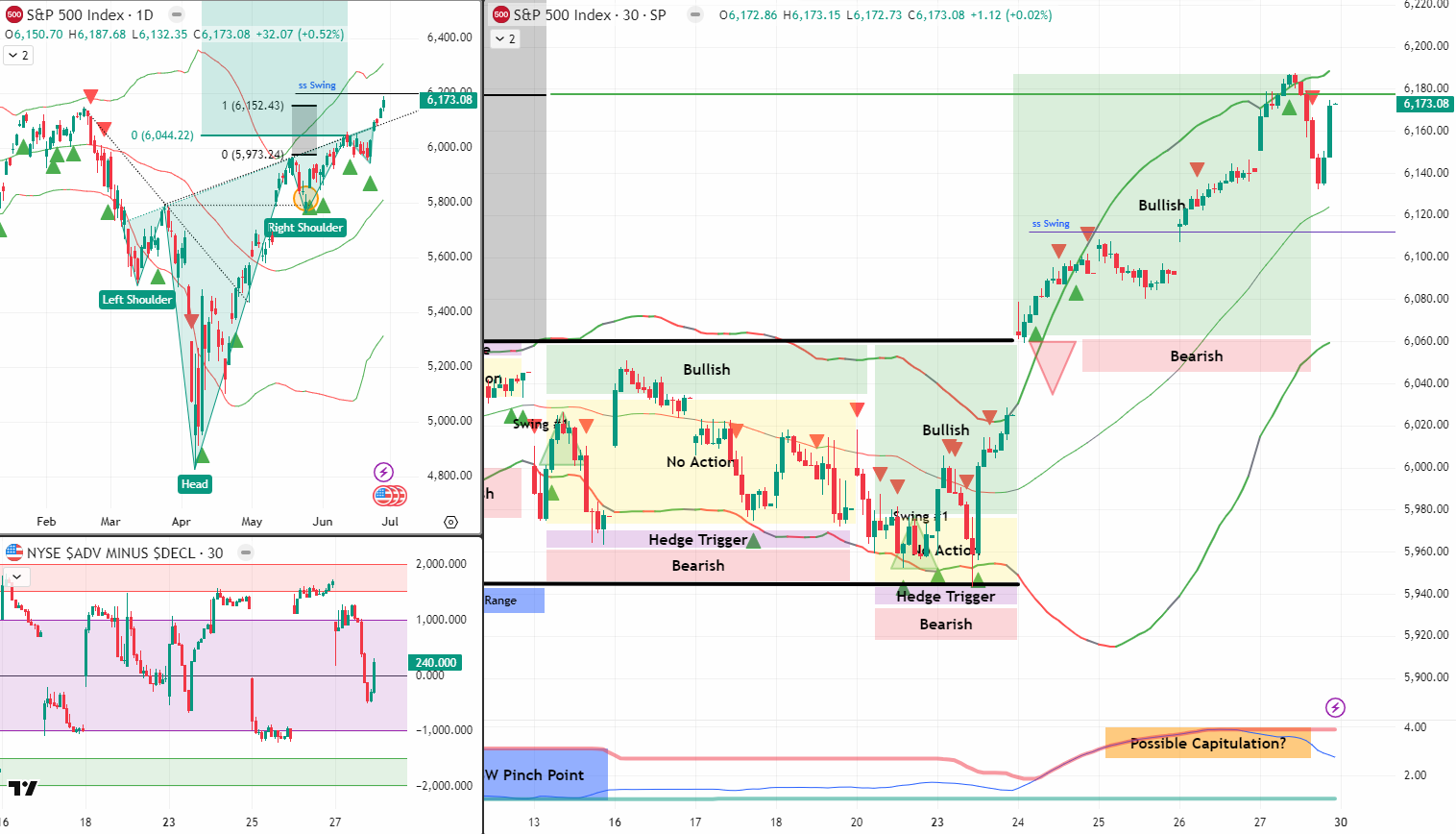

We saw the breakout of that well defined range we flagged back on 12/13 June. After price reversed off the range low my students and I bagged a string of stellar trades. Now a new week greets us – end of month, start of month, NFP on Friday and a fresh Bollinger squeeze on the tape. Time to map the likely pause and plan the next strike.

▶️ Grab coffee, scroll down, and lock in your game plan.

SPX Market Briefing

Friday’s session kicked off the first noticeable Bollinger Band contraction in two weeks. A squeeze by itself is no trigger, but coupled with the calendar it screams “cool-down.”

We also reached the measured breakout target. That target tap came with an upper Tag n Turn – a classic “cash the ticket, take a breath” marker. I do not expect a face-melting selloff, yet I’m even less inclined to chase fresh highs.

Strategy for the next 48-72 hours is simple: credit spreads out the money, 2-DTE to 3-DTE, letting theta bleed while SPX drifts, and wait for Friday’s jobs print.

Key levels

• 6180/6200 – breakout target and Friday high – resistance until decisively cleared

• 6160 – Friday midpoint – intraday pivot

• 6100/6120 – Possible range lows (assuming BB contraction develops)

• >6200 – New Breakout – line where bullish bias returns

Happy trading,

T2 Markets